Digitalscouting.de has the honor to publish a article by Zarc Gin from our Chinese media partner Insurview:

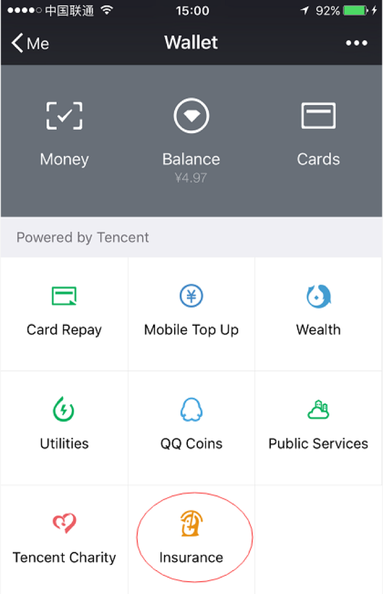

Tencent, China’s social network giant has released its proprietary insurance platform Wesure within its social app, Wechat on 2nd Nov. 2017. It is not the first move Tencent made in insurance, but it’s the most straightforward one so far. It is clear that Tencent does not want to fall behind in the Fintech race against its domestic rivalry Alibaba, who already launched an insurance platform and claims solution via its Fintech arm – Ant Financial.

Tencent and Alibaba are the two best tech companies in China and they are trying to expand business in every corner of people’s lives. Both of them have been developing at a tremendous pace in 2017 and have come close to Facebook and Amazon in terms of market cap.

China’s insurance market is growing – Digital Insurance grew by factor 10

Insurance is a huge market in China. Annual premium income has grown from 1.4 trillion RMB (USD 21.12 million) in 2011 to 3.1 trillion RMB (USD 46.77 million) at a 16.8% CAGR. The market size of insurance in China has surpassed Japan and is second to only the US market. In terms of Digital Insurance’s market, it has grown 10 times since 2012 yet still accounts for less than 10% of the overall domestic insurance market. So it is obvious that with the increasing development in InsurTech, plus the continuous expansion of the whole insurance market, the Digital Insurance will thrive and prosper at an unbelievable speed in the near future.

902 Million Daily Active Users: Wechat

Therefore, it is no wonder not only the traditional insurers are trying to keep relevant in this new digital front, tech giants also want to take their seats as early as possible and make the most of their digital advantages.

Alibaba’s advantage lies in payment, while Tencent’s in social, in other words, Wechat. According to data released from Wechat team, the number of Wechat daily active user reached 902 million in September, 2017, which is a 17% YoY growth. The total population in US is only 319 million! So customer acquisition won’t even be a problem for Wechat.

Clear and simple

Right now, there is only one product in Wesure. It is a medical policy called WeCare and is co-launched with licensed digital insurer Taikang Online. Policyholders can get a 6 million RMB coverage with no deductibles and related hospital services with a few hundreds RMB premium. Compared with other medical and health coverage in China, WeCare is quite attractive no matter in coverage or in premium. But what’s even more important, it is clear and simple. With only a few illustrations, customers can easily understand what the policy offers.

It is clear that Tencent is in no rush to push forward their insurance strategy. Not like insurance supermarkets and compare sites, Tencent will be offering only refined products in small quantities. For example, only 2-3 products for each insurance category. Personalized insurance will also be the future of Wesure.

Wesure also provide customers with policy management services and Wechat users can review and renew their policy easily inside the app.

Wesure: Top-notch user experience deceicive

Liu Jiaming, CEO of Wesure told reporters that they will launch auto insurance in the near future, but since most of the customers are satisfied with their current auto insurer, Wesure is planning to focus on after-sale service, like quoting for renewal policies. And they might even build an eco-system centering auto insurance, like providing maintenance and car washing services for those who purchased auto insurance in Wesure.

Wechat has proved they can conquer Chinese social market by providing customers with top-notch user experiences. Now they are expanding on root of this social dominance. What’s more valuable is that they are proceeding with prudence and has not forgotten to put customer in the center. So we have got tech giants like Tencent and Alibaba, traditional insurers like Ping An and start-ups like Zhong An all playing in the Digital Insurance field now, it will be very interesting to see who will win the ultimate victory. Something even more interesting is that Zhong An was co-founded by Tencent, Alibaba and Ping An, so his major stakeholders may end up becoming his toughest opponents.

Author of this article is Zarc Gin from InsurView. If you are interested in Chinese InsurTech community and want to learn more, you can contact Zarc via Linkedin or zarc@warpvc.com